Quantiacs Q5 Contest – Terms and Conditions

A. NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN THIS CONTEST OF SKILL.

B. BY ENTERING THIS CONTEST, EACH ENTRANT CERTIFIES THAT HE/SHE MEETS ALL ELIGIBILITY REQUIREMENTS AND AGREES TO ACCEPT AND BE BOUND BY ALL OF THESE TERMS AND CONDITIONS (the “Official Rules”).

1. Sponsor: This Quantiacs Q5 Contest (the “Contest”), is sponsored by Quantiacs, LLC (the “Sponsor”), a Delaware limited liability company located at 445 Cambridge Avenue, Suite B, Palo Alto, California 94306. The Contest is governed by the laws of the state of California.

2. Eligibility: Participation in this Contest is open only to natural persons who meet all of the following conditions (“Participants”): (i) they are eighteen (18) years of age or older at the time of entry in the Contest; and (ii) they agree to the terms and conditions of the Sponsor’s User Agreement available at www.Quantiacs.com. Eligibility to compete for any prizes awarded by this Contest is further limited to “unique” Trading Systems as set forth herein. You are not eligible to receive the Grand Prize if you are a Specially Designated National or reside in a country designated by the United States Treasury’s Office of Foreign Assets Control (

http://www.treasury.gov/resource-center/sanctions/Programs/Pages/Programs.aspx). The Sponsor reserves to modify the eligibility requirements for entry during the course of the Contest if less than thirty (30) Participants have entered the Contest by March 9, 2016 as described below. Upon request, the Sponsor reserves the right, in its sole discretion, to waive certain eligibility requirements for otherwise qualified persons. VOID WHERE PROHIBITED.

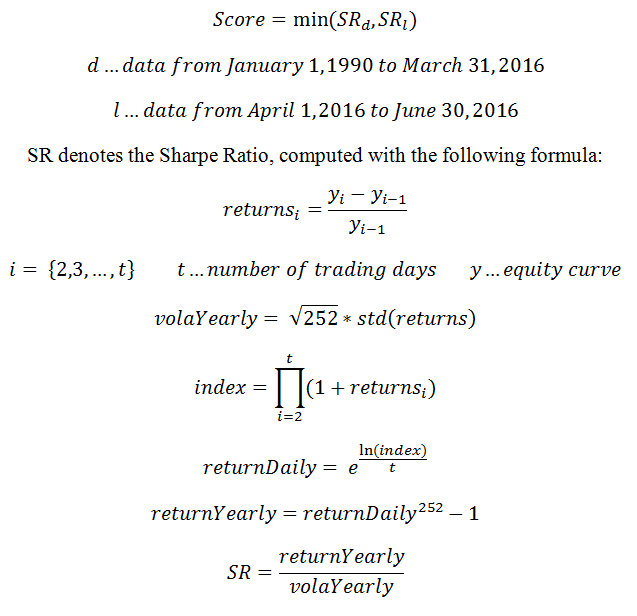

3. Contest Summary: Participants are invited to submit algorithmic Trading Systems (as further defined below) over the Sponsor’s website at www.Quantiacs.com. Using the performance criteria set forth herein, these Trading Systems will be evaluated using historical and live futures trade data from January 1, 1990 through June 30, 2016. The three Participants submitting Trading Systems that achieve the three highest Scores (as defined below) will be awarded allocations to their strategies (a “Grand Prize”), as set forth below.

4. Entry Period: Entries will be accepted from 12:00:01 a.m. on January 1, 2016 until midnight on March 31, 2016 (the “Entry Period”). If as of March 9, 2016, less than thirty (30) Participants have submitted entries, the Sponsor may, in its sole discretion, cancel the Contest, in which event no awards or prizes will be granted or distributed in connection with the Contest.

5. How to Enter: To enter, Participants must upload a Trading System (as defined below) during the Entry Period to www.Quantiacs.com by following the instructions posted there. Participants must include with their submission the following information: his/her name; his/her email address; and his/her residential mailing address. A Participant may not submit entries using multiple or different email addresses or residential mailing addresses. A Participant may submit up to ten (10) Trading Systems per day during the Entry Period; provided however that each Participant’s single qualifying entry will be the Trading System that produces the highest Score as of the last day of the Live Period as defined below by these Official Rules. No single Participant may receive more than one of the three Grand Prizes defined herein.

6. Live Contest Period: The Contest starts on April 1, 2016 at 12:00.01 a.m. and ends on June 30, 2016 at midnight (the “Live Contest Period”). During the Live Contest Period, no changes may be made to Trading Systems entered in the Contest. The results of all participating Trading Systems will be updated daily during the Live Contest Period, as new market data arrives. The results will be published on www.Quantiacs.com.

7. Trading System Technical Requirements and Trading Rules: Participating algorithmic trading systems (“Trading Systems”) must be developed in accordance with and meet the following requirements:

a. Trading Systems must be developed solely with the market data that is provided by the Sponsor. The market data consists of end of day data of a selection of futures contracts. The composition of the portfolio may change during the contest if additional market data is provided by the Sponsor. It is within each Participant’s discretion to select his or her portfolio from the available futures market data provided by the Sponsor.

b. If the Sponsor determines, in its sole discretion, that market data is erroneous, the Sponsor reserves the right to correct the market data in any phase of the competition.

c. The code of a Trading System must be compatible to Matlab® 2014a and be compatible with the Sponsor’s evaluation routines. A sample evaluation routine is provided in Sponsor’s development toolbox on www.Quantiacs.com. The evaluation routine on the servers may differ from the sample evaluation. The following Matlab®-Toolboxes (R2014a) are supported: Statistics, Optimization, Signal Processing, Neural Network, Global Optimization, Financial, Econometrics and Curve Fitting.

d. Alternatively participants may choose to use Python compatible with version 2.7.9 and the Sponsor’s evaluation routines. A sample evaluation routine is provided in the Sponsor’s development toolbox on www.Quantiacs.com. The evaluation routine on the servers may differ from the sample evaluation. The following Python toolboxes are supported: keras, pandas, numpy, scikit-learn, scikits.statsmodels, TA-lib, tensorflow, theano, and xgboost.

e. The evaluation routine simulates the interaction with a broker and computes the portfolio equity curve. The Sponsor reserves the right to correct bugs in the evaluation routine during the course of the Contest. In such a scenario, all Participants will be notified about the correction, Trading Systems will be computed again and the corrected portfolio equity curves will be displayed at www.Quantiacs.com.

f. A Trading System only qualifies for a Grand Prize if it would have produced the same returns, Sharpe Ratio and Score were it traded live during the Live Contest Period with an arbitrary broker account. In other words, simulated performance, Sharpe Ratio and Score cannot result from exploitation of a bug in the back-testing Toolbox or a loophole in the Official Rules.

g. Each Trading System must use the same rules for the entire Evaluation Period and may not vary in relation to changes in timescale for arbitrary periods of years (e.g. “don’t trade in 2008” is an invalid rule).

h. Each Trading System must use quantitative rules only, and generate the same result if run twice on the same portfolio.

i. It is possible to trade long and short.

j. A transaction fee of 5% * HIGH-LOW is deducted for every change in position size. This simulates the impact of slippage and commissions. HIGH and LOW denote the highest and lowest price of the trading day on which the change in position size takes effect.

k. The longest permitted lookback period is 2520 trading days.

l. Each Trading System must have a runtime of less than ten minutes on the Sponsor’s servers.

m. If a Trading System causes a runtime error, all positions will be closed. It will be called again with the next available set of market data, and so forth. As soon as the Trading System resumes functioning, positions will be built up accordingly.

n. The use of the following Matlab items and their Python equivalents are prohibited

i. MEX-files

ii. Java commands or object creation

iii. eval, feval, inline, and function handles

iv. Shell escapes such as !, dos, unix, and system

v. Handle Graphics commands

vi. ActiveX commands

vii. File I/O commands

viii. Debugging commands

ix. Printing commands

x. Simulink commands

xi. Benchmark commands such as tic, toc, flops, clock, and pause

xii. error, clear, and persistent functions

xiii. web, urlread, ftp, mget, urlwrite, web, webread and webwrite

o. Entries compromising contest machinery are prohibited and will result in disqualification.

p. Manipulating the Score, runtime, or error conditions is prohibited and will result in disqualification.

q. If a Trading System depends on auxiliary files that cannot be embedded in the function template (e.g.; neural network settings) these files may be emailed to info@quantiacs.com and can be used in the competition after passing a manual security and rule compliance inspection. It is in the Sponsor’s sole discretion to accept or reject auxiliary files.

8. Evaluation and Scoring: At the end of the Evaluation Term, the final “Score” of all participating Trading Systems will be computed as follows:

9. Prizes:

a. Eligible Participants who submit a “unique“ Trading System during the Entry Period compete for the grand prize. An entry shall be deemed unique, if:

i. the linear correlation to any Trading System previously submitted by any other Quantiacs User does not exceed 0.8.

ii. the linear correlation to any of the Trading Systems submitted by Participant before Jan 1, 2016 does not exceed 0.8; and

iii. the linear correlation to any Sample Trading System previously published in any form by the Sponsor does not exceed 0.8.

The correlation shall be computed as the linear correlation of the returns of the trading system’s equity curves.

In other words, Participants cannot submit Systems that other Users have submitted to Quantiacs already. Participants aren’t allowed to re-submit Systems they already had submitted to Quantiacs before the start of this competition. Participants may tweak their own, new systems during the course of the competition.

b. Each Participant’s single qualifying entry for the Grand Prize shall be the Trading System that produces the single highest Score for the Evaluation Period regardless of the number of Trading System the Participant has submitted. The three Participants having the three highest overall Scores at the end of the Live Contest Period will be awarded an allocation to their strategy, as set forth below, commencing no later than within thirty (30) days of the conclusion of the Live Contest Period. The winners shall receive performance fees of ten percent (10%) of Net New Profits based on the performance of their Trading Systems as set forth in the Sponsor’s User Agreement. The allocations shall continue for a minimum of one (1) year provided that the Trading System’s Score does not drop below its Score as of the conclusion of the Live Contest Period. If the live Sharpe Ratio of a Trading System (i.e. the Sharpe Ratio of all trading days subsequent to the commencement of the Live Contest Period) drops below the Score of the Trading System as of the conclusion of the Live Contest Period, then the Sponsor, in its sole discretion, may reduce or eliminate the allocation to a winning Trading System. The amounts allocated to the winning Trading Systems are:

Highest Score: $1,000,000

Second highest Score: $750,000

Third highest Score: $500,000

c. The awards will be made to the winning Participants within thirty (30) days of the termination of the Contest provided that the winning Participant has completed any necessary documentation related to the award, including but not limited to any applicable forms required by the United States Internal Revenue Service. No payment or purchase is necessary to win.

d. Prize awards are subject to verification of eligibility and compliance with these Official Rules. Prize awards are non-transferable and non-assignable.

10. Miscellaneous:

a. All times used in these Official Rules are Pacific Standard Time.

b. The Sponsor reserves the right, in its sole discretion, to exclude, bar or otherwise penalize any Participant if such Participant’s Contest entry contains malicious or harmful code or if such Participant otherwise poses any threat of damage to the Sponsor or the integrity of this Contest.

c. By submitting a Trading System to the Sponsor, each Participant grants to the Sponsor the License to use the Trading System as set forth in the Sponsor’s User Agreement.

d. The Sponsor reserves the right, in its sole discretion, to modify the Official Rules if necessary to preserve the integrity of the Contest.

e. The Sponsor reserves the right to disqualify and prohibit from participating any person who the Sponsor determines in its sole discretion is or is attempting to (i) tamper with Sponsor’s website; (ii) undermine the legitimate operation of the Contest by cheating, deception or other unfair tactic; and/or (iii) otherwise violate these Official Rules or Sponsor’s User Agreement.

f. All taxes, fees and surcharges on awards and prizes are the sole responsibility of the winner. In the event that a winner is ineligible or refuses an award or prize, the award or prize will be forfeited and Sponsor, in its sole discretion, may choose whether to grant the award or prize to another Participant.

g. Whenever possible, each provision of these Official Rules shall be construed and interpreted in such a manner as to be effective and valid under applicable law, but if any provision of these Contest Rules or the application thereof to any party or circumstance shall be prohibited by or invalid under applicable law, then such provision shall be ineffective to the extent of such prohibition without invalidating the remainder of such provision or any other provision of these Contest Rules or the application of such provision to other parties or circumstances.

h. Participation in the Contest is subject to all federal and state laws and regulations. Void where prohibited. Each Participant is responsible for checking applicable laws and regulations in your jurisdiction before participating in the Contest to ensure that his/her participation is legal.